Spring, School Holidays & Exciting Updates!

The school holidays are in full chaotic swing, and we’re just about to depart for a much-needed getaway to Fiji. Don’t worry — we’ll still be accessible while away… probably by the pool, cocktail in hand! 🍹

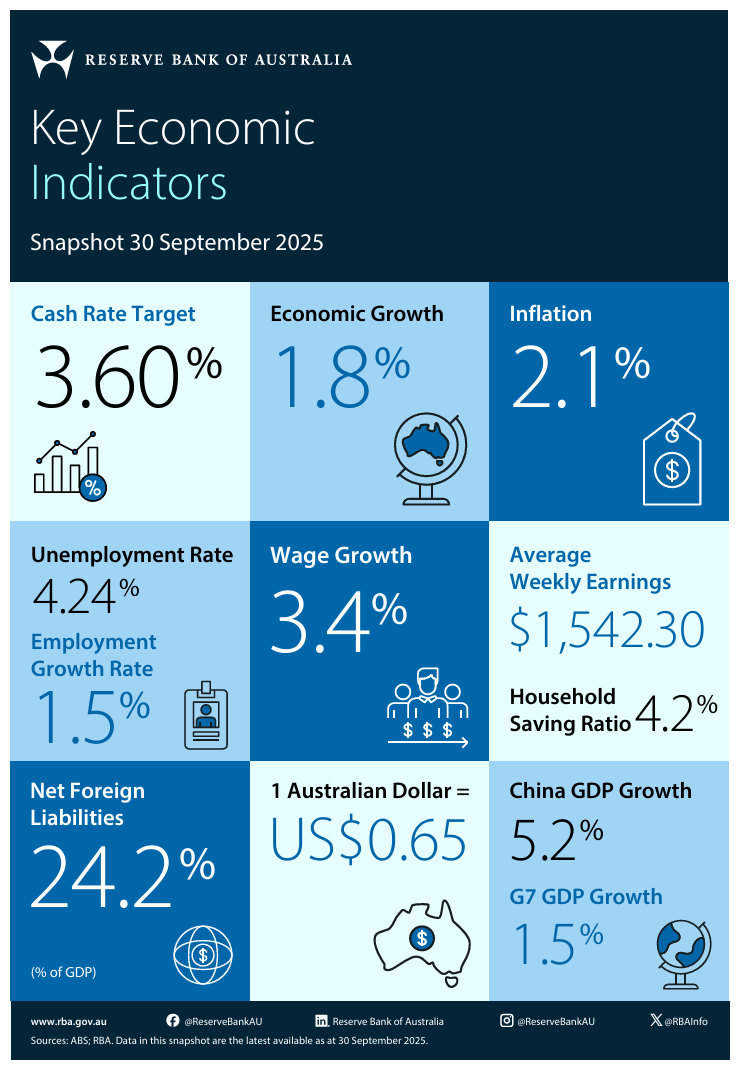

Here’s a snapshot of what we’ve been up to over the past three months:

Client Growth: Since our last newsletter, we’ve welcomed 13 new clients into the Blue Sky family — an unlucky number for some, but certainly lucky for us!

Refinance Rebate Market: ANZ has become the last major bank to exit the refinance rebate space. This leaves only ME Bank, People’s First Bank, and Bank of China offering cash back options:

ME Bank: $3,000 cashback on home loans ≥ $700,000 (owner-occupier and investor; max LVR 80%)

People First Bank: $1,000 cashback on refinances ≥ $500,000 (LVR < 80%; offer until 30 June 2026)

Bank of China: $2,000 cashback on loans ≥ $400,000 (applies to new purchases or refinances)

Refinance Wins:

We recently saved a client 0.89% on her ANZ refinance, putting nearly $5,000 back in her pocket each year.

Pricing Wins:

With our client review process, we saved another client $3,124 p.a.

It’s been a busy few months, and we love helping our clients make the most of their home loans — whether it’s buying, refinancing, or finding the best cash-back deals.

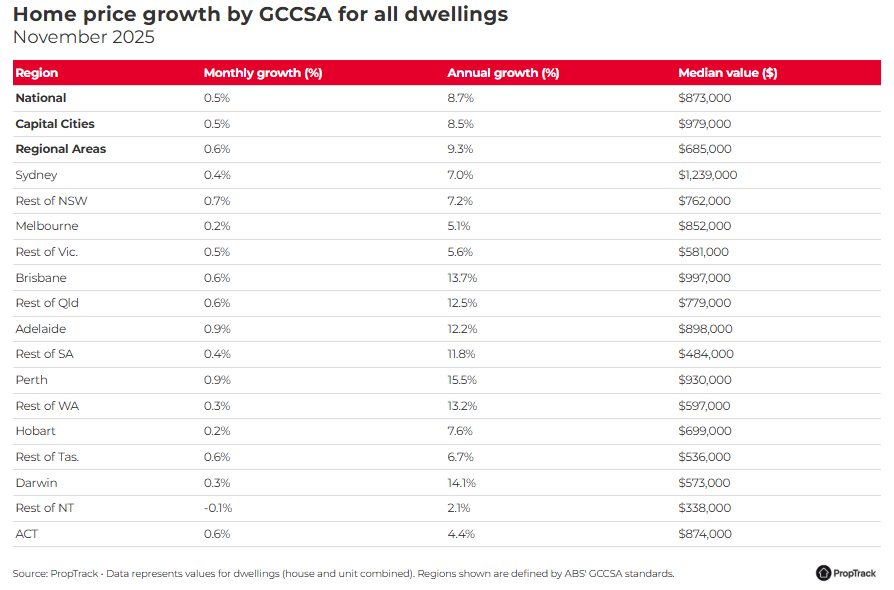

The 5% deposit scheme will help more first-home buyers from today - but the market will 'explode'